Start using Analyser.

A quick video guide to evidencing platform-to-platform switches inside Analyser.

- All

- Due diligence

- How to

- MPS

- Platforms

- Product news

- Suitability

- User stories

Access State of the Platform Nation, our annual deep dive into the UK platform market, with an Analyser Everything subscription.

Mark and Rich share a sneak peek at this year’s State of the Platform Nation report.

How much weight should platform profitability be given in due diligence? And where does profit fit in the overall picture?

Access platform market data at a glance plus the latest platform and MPS developments.

New pricing has been rolled out for existing Wrap clients, with charges first applied on 5 March.

Access to LV=’s smoothed managed fund range, with platform charges starting at 0.27%.

Analyser’s latest integration is now live with ZeroKey, a web extension that aims to remove the need to manually key data. ZeroKey was among five firms chosen to showcase emerging technology at the lang cat’s AdviceTech Catwalk event last summer. It was ultimately voted ‘best in show’ for its ability to save advice professionals’ time

Supporting advice professionals with platform-to-platform transfers is a key focus of our latest Analyser update, alongside new features to help streamline provider relationships. Moving clients between platforms can be complex and time-consuming. While we can’t control industry-wide transfer processes, we can help advisers better document and justify their platform switching recommendations – especially important under

You can now research and compare Saltus Portfolios as part of your MPS due diligence inside Analyser. Saltus was founded in 2004 with the aim of bringing institutional style fund management to UK private clients. Saltus launched its MPS ranges in 2014, and currently has over £5bn in MPS assets under management. The Saltus investment

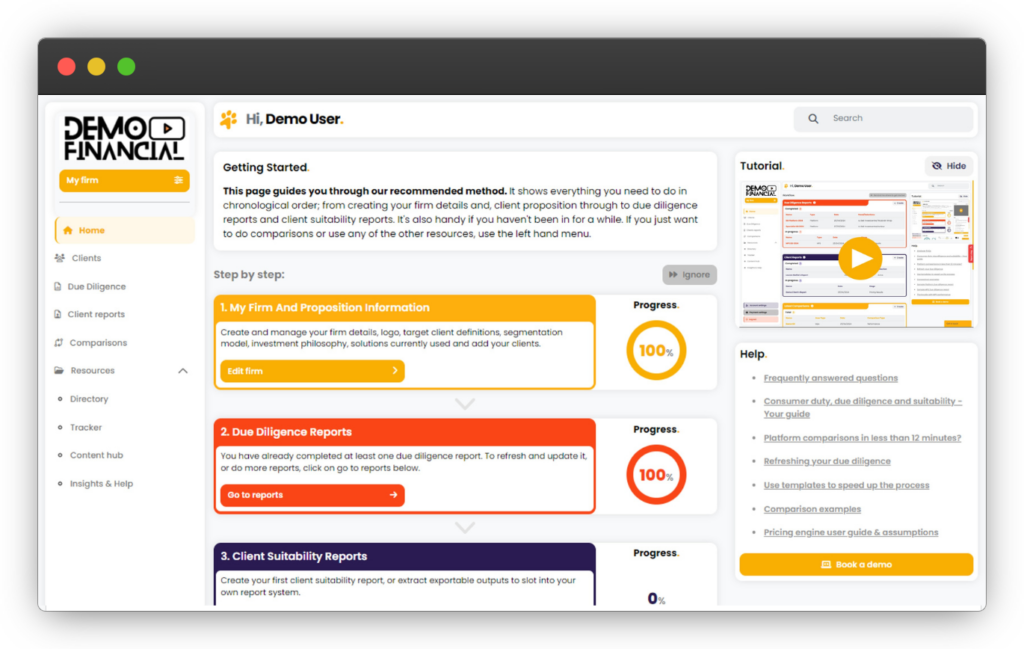

For financial advice professionals, conducting thorough platform and MPS due diligence is essential. Analyser streamlines this process, offering a data-driven approach to assess and compare platforms whilst maintaining independence from providers. Understanding your options The Everything plan If your firm regularly reviews platform suitability and needs ongoing access to market insights, the Everything plan provides

We’re proud to announce Analyser’s first ever integration is now live with AI reporting firm Avenir. Avenir, which uses AI to make reporting for advice firms more efficient, appeared at the lang cat’s AdviceTech Catwalk event last summer. It was one of five firms to showcase emerging tech for advice professionals. With this integration, Analyser

So here we are, the end of another year. 2024 has been a busy one, and the impression we get is that goes as much for you as advice professionals as it does for us at Analyser. Here’s a snapshot of some of things we’ve been up to in order to support and inform your

As Digital Director at the lang cat and one of the team behind Analyser, our platform and MPS due diligence and suitability tool, Terry Huddart works with platform information daily. His position gives him unique access to comprehensive data and intelligence on all UK retail platforms. Through Analyser, he can also build an in-depth understanding

Scottish Widows is rolling out a new brand identity, replacing its “living logo” with a digital logo instead. The new logo has now been updated across Analyser, which subscribers will see when reviewing platforms and carrying out due diligence. There is no change to the Scottish Widows name or legal entities. The new logo, colours

CS Investment Managers has rebranded with immediate effect, with the discretionary investment management firm now known as Charlotte Square Investment Managers. The rebrand and the firm’s new logo have been updated across Analyser which subscribers will see reflected the next time tyou reviewing your chosen MPS providers. Subscribers can find out more Charlotte Square Investment

Subscribers to Analyser can now catch up on the latest edition of Adviser Briefing, covering platform market data for Q3 2024. This includes our market at a glance tables, and a summary of the latest developments across platforms and MPS providers. Subscribers can also catch up on the impact of the budget in this issues

Wealthtime, previously known as the Novia platform, has agreed a new deal with platform tech provider GBST and Indian technology firm Wipro.

You can now compare and research Invesco as part of your MPS due diligence in Analyser.

Subscribers to Analyser can now catch up on the latest edition of Adviser Briefing, covering platform market data for Q2 2024. This includes our market at a glance tables, and a summary of the latest developments across platforms and MPS providers. Subscribers can also catch up on the lang cat’s latest analysis on platform switching

Five portfolios from Pacific Asset Management are now available to include in the comparison, due diligence and suitability exercises.

Analyser can be used by many sections of the financial advice and planning sector, including platform and MPS providers.

ESG Accord’s team bring us up to speed with the FCA’s stance on greenwashing and what this means for advice professionals

Fusion Wealth platform has updated its data inside Analyser across a range of data points.

Marlborough MPS ranges are now available through Analyser. You can now include their Active, Blended and Passive ranges in the comparison, due diligence and suitability exercises you run in Analyser.

Analyser has been updated to include the Dimensional Core, Core Plus and Sustainability Wealth Models – a set of portfolio suites offered by Dimensional and implemented by ebi Portfolios.

Two MPS ranges from MAIA are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. The ranges are: These are available on eight platforms. MAIA says it is “open-minded” in its investment strategy, allowing for more esoteric funds as part of its asset allocation and will consider funds

Subscribers to Analyser can now catch up on two essential pieces of insight into the platform market: Both pieces of insight are available exclusively to subscribers and are essential reading for anyone serious about platform and investment due diligence. There’s no need for you to miss out. You can give Analyser a go with a

Five portfolios from Morningstar Wealth are now available to include in the comparison, due diligence and suitability exercises you run in Analyser.

Analyser 3.0 is now even easier to use, and offers new functionality to carry out due diligence at individual client level

Liontrust’s managed portfolio service is now available for Analyser subscribers to compare and research as part of their investment due diligence. Liontrust launched as an asset manager in 1995 and listed on the London Stock Exchange in 1999. Its MPS was launched in 2014 and it has £138m in MPS assets under management as at

Copia Capital has launched two new MPS ranges designed for clients in retirement. These ranges can now be assessed and compared on Analyser. Copia was formally launched as a DFM in 2016 and started out life as a division of the Novia platform, which has since rebranded to Wealthtime. Its new ranges are: · Select Retirement

Mark Polson runs the rule over abrdn’s new charging structure.

Abrdn has made changes to abrdn Wrap charging structures today and we’ve added these to Analyser for use in your due diligence and comparisons. Changes include:

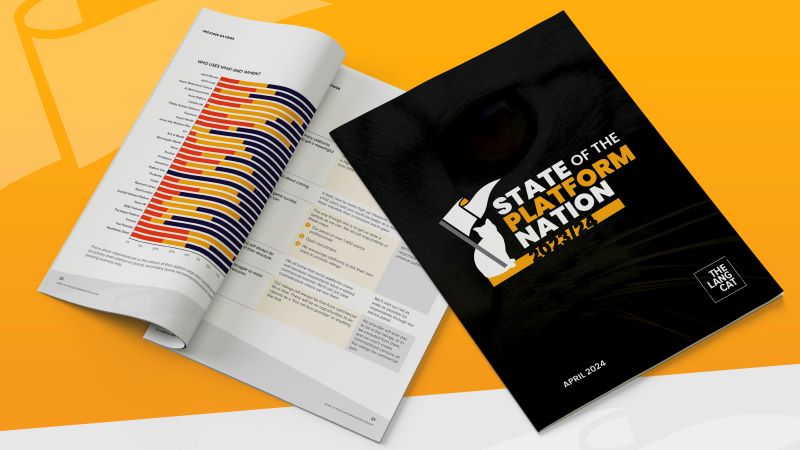

Every year, the lang cat publishes the State of the Platform Nation report – our annual deep dive into platforms in the UK. The 2023/24 report is the 12th edition and reviews the previous year and sets out what we think the future holds for platforms. 2023 will go down as one of the toughest

AJ Bell has made changes to its charging structure including a new tier and scrapping certain SIPP-related charges, and Analyser has been updated to reflect this.

Jessica Lyons is a financial adviser at Black Swan Financial Planning shares their approach to platform reviews

For advice professionals, Analyser can help lighten the load and speed up the research process that comes with tax year end.

LGIM’s model portfolio service is now available for you to research as part of your investment due diligence inside Analyser.

Every quarter we update Analyser with the latest performance data for MPS propositions. Performance data for Q4 2023 is now live on Analyser.

How do you know who is doing what when it comes to Consumer Duty? You can find out how providers are approaching it through Analyser

One of the main outcomes the FCA wants to see as part of the Consumer Duty is around consumer understanding.

If you want to use Analyser to help with your compliance with Consumer Duty when it comes to platform and investment selection, then look no further.

CS Investment Managers’ managed portfolio service is now available on Analyser for review as part of your investment due diligence.

Thinking about the year ahead, how confident are you about the platforms and investments you’re recommending to clients?

Barras Capital Management are now available on Analyser

The Blackfinch managed portfolio service has now been added to Analyser for you to include as part of your investment suitability process.

The new platform from fund group Marlborough is now available to research and assess in Analyser.

Requested by an Analyser subscriber, Blackfinch Investments portfolios are now available to include in the comparison, due diligence and suitability exercises.

Nucleus has made changes to its standard pricing with effect from 1 December 2023, and Analyser has been updated to reflect this.

When the Transact – BlackRock MPS launched over a year ago, it marked a couple of ‘firsts’.

We often say that no two advice firms are the same, and that’s definitely the case when it comes to reviewing your platforms. We carried out a straw poll recently to gauge how often advice professionals refresh their platform due diligence. Respondents had the option of either quarterly, half yearly, yearly or ‘we don’t, once

The zeitgeist around ESG has changed over the past year or so. For firms that specialise in ESG advice or sustainable investing, nothing has changed – it’s business as usual. But looking across the advice sector, there will be advisers who have gone from seeing ESG funds regularly appearing at the top of the tree

We’ve been busy making improvements to the reports subscribers can generate using Analyser. Just one more improvement to your due diligence and suitability process available through Analyser.

We’re pleased to announce that Analyser has teamed up with new professional indemnity insurer BareRock as part of a drive to shake up how PII cover is offered to advisers. BareRock has developed a PII service which is designed to be more personalised and based on individual firm risk rather than industry averages. Under the

BlackRock offers users of the Transact platforms access to a range of seven model portfolios, and now advice professionals can include these in MPS due diligence exercises carried out through Analyser.

In this short video, Terry and Chris show you how to compare portfolio charges across MPS ranges in a matter of minutes.

Join Terry Huddart and Chris Bredin as they show how you can compare MPS performance quickly and easily.

Analyser has been updated to include the ebi Vantage Core, Core ESG and World ranges.

Embark becomes Scottish Widows and Analyser has been updated to reflect this change

If you don’t know where to start with your due diligence and suitability in this Consumer Duty world, we have your back.

Wealthtime platform has now rebranded to Wealthtime Select. The move is part of a wider rebranding exercise which will see Novia rebrand to Wealthtime later this year. Wealthtime Select and Novia are both owned by private equity firm AnaCap. The ownership structure remains the same, with Wealthtime Select and Novia continuing to operate as separate

Analyser has been updated with Sparrows SCore Market Funds (Index Funds Only) ranges.

Canaccord Genuity Wealth Management now available on Analyser

Aspen managed portfolio service is now on Analyser and available for review as part of your investment due diligence.

Join Terry Huddart and Chris Bredin as they show how you can compare platform functionality in a matter of minutes. This is especially useful if you need to export the results into a spreadsheet to share with colleagues or include in reports. Experience it for yourself and start your 14 day free trial.

Deciding which platforms and MPS are core to delivering your proposition and you need to be able to explain the thinking and process behind your decisions. That’s what we preach and it’s about time we took our own advice and explained the thinking and process built into Analyser. So, join Terry Huddart and Mark Polson

You might remember that Novia introduced a new charging structure this year. The first phase was rolled out in January and applied to firms with over £10m in assets on the platform. This saw the number of standard charging tiers go from five to three, with the charge for the lower tiers going from a starting

Charles Stanley’s managed portfolio service is now available to review in Analyser as part of your MPS due diligence. Charles Stanley’s origins trace back to 1792, making it one of the oldest firms on the London Stock Exchange. The company operates a 35-strong research and asset management team, and a key part of its approach

Among the latest wave of MPS providers to join Analyser is Puma Investments. Puma was initially set up to build on a series of venture capital trusts known as the Puma VCTs which had been managed by Shore Capital. It was established as an independent company by chief executive David Kaye in 2012. The Puma AIM

Analyser has been updated to reflect the rebrand of Hubwise to SS&C Hubwise. You’ll notice this change in the Platform Directory and when you run comparisons, due diligence and suitability exercises. This follows SS&C Technologies acquisition of Hubwise and the integration of the platform into the wider SS&C business. The first step as been to

Four MPS ranges from abrdn are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. The ranges are: For details of cost, performance, investment approach and much more on these ranges, log into Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all

We’ve updated Analyser with Quilter’s new platform pricing and subscribers can now: Subscribers to Analyser will benefit from a detailed analysis of the Quilter’s new platform pricing and its implications shortly. Refresh your due diligence Refreshing your due diligence regularly is a matter of minutes as Terry demonstrates in this video.

Artbuthnot Latham portfolios are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a MPS provider or range that you’d like to see on Analyser, let us know and contact the provider

If it’s a quick comparison of platform features you’re after, Analyser can help with that. In this video Terry shows you how to compare as many platforms as you like all in one place, in no time whatsoever.

Puma Investments portfolios are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. They are currently one of only two providers that offer an AIM/IHT specific range on Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a

O-IM portfolios are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. They are currently one of only two providers that offer an AIM/IHT specific range on Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a MPS

Charles Stanley Wealth Managers range of portfolios is now available to include in the comparison, due diligence and suitability exercises you run in Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a MPS provider or range that you’d like to see on Analyser, let

With Analyser, you’re able to set up your client segments and then tailor your suitability and due diligence to each segment. What’s more, you can also add your own custom pricing. In this video, Abbey and Terry explain how.

With end of tax year done and dusted, it’s the perfect time for a bit of spring cleaning and catching up on those tasks you’ve been putting off for a while. Not to mention acting on some of the changes announced in the latest Budget. In this video, Abbey and Terry take you through a

Quilter Cheviot’s managed portfolio service is now available to review in Analyser as part of your MPS due diligence. One of the UK’s largest DFMs, Quilter Cheviot launched its MPS in 2001 which has £1.49bn in assets under management as at 30 September 2022. It offers five MPS strategies based on what it calls its ‘building

Last week we held an Analyser clinic all geared around refreshing your due diligence, and what this means in practice. Terry and Abbey covered a lot of ground, including why you might choose to review your chosen platforms and providers more than annually, and how technology can help speed up the process. On platforms in

King & Shaxson is now available to review in Analyser as part of your MPS due diligence.

EPIC Investment Partners is one of the latest MPS providers to go live on Analyser, and is now available for review as part of your MPS due diligence. The company was founded in 2001 by Giles Brand and Hiren Patel, who both have backgrounds in private equity. The MPS range was launched in July 2021,

Not sure where to start with your due diligence? We can help with that. We recently added six templates to Analyser to give you a head start on due diligence. They are: These templates have lang cat knowledge and experience baked in. They also benefit from what we know about how Analyser users are using

We’re kicking off 2023 in style with news of a brand-new development – Analyser templates. Here’s a quick rundown of what we’ve built and why.

When we first set up Altor six years ago, we did our initial platform due diligence manually. As a small advice business, we didn’t want to pay lots of money to get an external consultancy to run a due diligence project for us. So we carried out a platform comparison exercise ourselves on a huge

I was originally introduced to Analyser by Terry Huddart at the lang cat, who asked me to be part of the original testing group ahead of Platform Analyser going live. At the time, there wasn’t much out there by way of support on platform due diligence. Some firms did some bits well, but there weren’t

Now that lots of you are starting to get to grips with the new MPS module in Analyser, questions are starting to come in about how we handle performance. Our approach is a bit different to the other tools out there, so read on to find out what we do and why we do it.

- All

- Due diligence

- How to

- MPS

- Platforms

- Product news

- Suitability

- User stories

A quick video guide to evidencing platform-to-platform switches inside Analyser.

Access State of the Platform Nation, our annual deep dive into the UK platform market, with an Analyser Everything subscription.

Mark and Rich share a sneak peek at this year’s State of the Platform Nation report.

How much weight should platform profitability be given in due diligence? And where does profit fit in the overall picture?

Access platform market data at a glance plus the latest platform and MPS developments.

New pricing has been rolled out for existing Wrap clients, with charges first applied on 5 March.

Access to LV=’s smoothed managed fund range, with platform charges starting at 0.27%.

Analyser’s latest integration is now live with ZeroKey, a web extension that aims to remove the need to manually key data. ZeroKey was among five firms chosen to showcase emerging technology at the lang cat’s AdviceTech Catwalk event last summer. It was ultimately voted ‘best in show’ for its ability to save advice professionals’ time

Supporting advice professionals with platform-to-platform transfers is a key focus of our latest Analyser update, alongside new features to help streamline provider relationships. Moving clients between platforms can be complex and time-consuming. While we can’t control industry-wide transfer processes, we can help advisers better document and justify their platform switching recommendations – especially important under

You can now research and compare Saltus Portfolios as part of your MPS due diligence inside Analyser. Saltus was founded in 2004 with the aim of bringing institutional style fund management to UK private clients. Saltus launched its MPS ranges in 2014, and currently has over £5bn in MPS assets under management. The Saltus investment

For financial advice professionals, conducting thorough platform and MPS due diligence is essential. Analyser streamlines this process, offering a data-driven approach to assess and compare platforms whilst maintaining independence from providers. Understanding your options The Everything plan If your firm regularly reviews platform suitability and needs ongoing access to market insights, the Everything plan provides

We’re proud to announce Analyser’s first ever integration is now live with AI reporting firm Avenir. Avenir, which uses AI to make reporting for advice firms more efficient, appeared at the lang cat’s AdviceTech Catwalk event last summer. It was one of five firms to showcase emerging tech for advice professionals. With this integration, Analyser

So here we are, the end of another year. 2024 has been a busy one, and the impression we get is that goes as much for you as advice professionals as it does for us at Analyser. Here’s a snapshot of some of things we’ve been up to in order to support and inform your

As Digital Director at the lang cat and one of the team behind Analyser, our platform and MPS due diligence and suitability tool, Terry Huddart works with platform information daily. His position gives him unique access to comprehensive data and intelligence on all UK retail platforms. Through Analyser, he can also build an in-depth understanding

Scottish Widows is rolling out a new brand identity, replacing its “living logo” with a digital logo instead. The new logo has now been updated across Analyser, which subscribers will see when reviewing platforms and carrying out due diligence. There is no change to the Scottish Widows name or legal entities. The new logo, colours

CS Investment Managers has rebranded with immediate effect, with the discretionary investment management firm now known as Charlotte Square Investment Managers. The rebrand and the firm’s new logo have been updated across Analyser which subscribers will see reflected the next time tyou reviewing your chosen MPS providers. Subscribers can find out more Charlotte Square Investment

Subscribers to Analyser can now catch up on the latest edition of Adviser Briefing, covering platform market data for Q3 2024. This includes our market at a glance tables, and a summary of the latest developments across platforms and MPS providers. Subscribers can also catch up on the impact of the budget in this issues

Wealthtime, previously known as the Novia platform, has agreed a new deal with platform tech provider GBST and Indian technology firm Wipro.

You can now compare and research Invesco as part of your MPS due diligence in Analyser.

Subscribers to Analyser can now catch up on the latest edition of Adviser Briefing, covering platform market data for Q2 2024. This includes our market at a glance tables, and a summary of the latest developments across platforms and MPS providers. Subscribers can also catch up on the lang cat’s latest analysis on platform switching

Five portfolios from Pacific Asset Management are now available to include in the comparison, due diligence and suitability exercises.

Analyser can be used by many sections of the financial advice and planning sector, including platform and MPS providers.

ESG Accord’s team bring us up to speed with the FCA’s stance on greenwashing and what this means for advice professionals

Fusion Wealth platform has updated its data inside Analyser across a range of data points.

Marlborough MPS ranges are now available through Analyser. You can now include their Active, Blended and Passive ranges in the comparison, due diligence and suitability exercises you run in Analyser.

Analyser has been updated to include the Dimensional Core, Core Plus and Sustainability Wealth Models – a set of portfolio suites offered by Dimensional and implemented by ebi Portfolios.

Two MPS ranges from MAIA are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. The ranges are: These are available on eight platforms. MAIA says it is “open-minded” in its investment strategy, allowing for more esoteric funds as part of its asset allocation and will consider funds

Subscribers to Analyser can now catch up on two essential pieces of insight into the platform market: Both pieces of insight are available exclusively to subscribers and are essential reading for anyone serious about platform and investment due diligence. There’s no need for you to miss out. You can give Analyser a go with a

Five portfolios from Morningstar Wealth are now available to include in the comparison, due diligence and suitability exercises you run in Analyser.

Analyser 3.0 is now even easier to use, and offers new functionality to carry out due diligence at individual client level

Liontrust’s managed portfolio service is now available for Analyser subscribers to compare and research as part of their investment due diligence. Liontrust launched as an asset manager in 1995 and listed on the London Stock Exchange in 1999. Its MPS was launched in 2014 and it has £138m in MPS assets under management as at

Copia Capital has launched two new MPS ranges designed for clients in retirement. These ranges can now be assessed and compared on Analyser. Copia was formally launched as a DFM in 2016 and started out life as a division of the Novia platform, which has since rebranded to Wealthtime. Its new ranges are: · Select Retirement

Mark Polson runs the rule over abrdn’s new charging structure.

Abrdn has made changes to abrdn Wrap charging structures today and we’ve added these to Analyser for use in your due diligence and comparisons. Changes include:

Every year, the lang cat publishes the State of the Platform Nation report – our annual deep dive into platforms in the UK. The 2023/24 report is the 12th edition and reviews the previous year and sets out what we think the future holds for platforms. 2023 will go down as one of the toughest

AJ Bell has made changes to its charging structure including a new tier and scrapping certain SIPP-related charges, and Analyser has been updated to reflect this.

Jessica Lyons is a financial adviser at Black Swan Financial Planning shares their approach to platform reviews

For advice professionals, Analyser can help lighten the load and speed up the research process that comes with tax year end.

LGIM’s model portfolio service is now available for you to research as part of your investment due diligence inside Analyser.

Every quarter we update Analyser with the latest performance data for MPS propositions. Performance data for Q4 2023 is now live on Analyser.

How do you know who is doing what when it comes to Consumer Duty? You can find out how providers are approaching it through Analyser

One of the main outcomes the FCA wants to see as part of the Consumer Duty is around consumer understanding.

If you want to use Analyser to help with your compliance with Consumer Duty when it comes to platform and investment selection, then look no further.

CS Investment Managers’ managed portfolio service is now available on Analyser for review as part of your investment due diligence.

Thinking about the year ahead, how confident are you about the platforms and investments you’re recommending to clients?

Barras Capital Management are now available on Analyser

The Blackfinch managed portfolio service has now been added to Analyser for you to include as part of your investment suitability process.

The new platform from fund group Marlborough is now available to research and assess in Analyser.

Requested by an Analyser subscriber, Blackfinch Investments portfolios are now available to include in the comparison, due diligence and suitability exercises.

Nucleus has made changes to its standard pricing with effect from 1 December 2023, and Analyser has been updated to reflect this.

When the Transact – BlackRock MPS launched over a year ago, it marked a couple of ‘firsts’.

We often say that no two advice firms are the same, and that’s definitely the case when it comes to reviewing your platforms. We carried out a straw poll recently to gauge how often advice professionals refresh their platform due diligence. Respondents had the option of either quarterly, half yearly, yearly or ‘we don’t, once

The zeitgeist around ESG has changed over the past year or so. For firms that specialise in ESG advice or sustainable investing, nothing has changed – it’s business as usual. But looking across the advice sector, there will be advisers who have gone from seeing ESG funds regularly appearing at the top of the tree

We’ve been busy making improvements to the reports subscribers can generate using Analyser. Just one more improvement to your due diligence and suitability process available through Analyser.

We’re pleased to announce that Analyser has teamed up with new professional indemnity insurer BareRock as part of a drive to shake up how PII cover is offered to advisers. BareRock has developed a PII service which is designed to be more personalised and based on individual firm risk rather than industry averages. Under the

BlackRock offers users of the Transact platforms access to a range of seven model portfolios, and now advice professionals can include these in MPS due diligence exercises carried out through Analyser.

In this short video, Terry and Chris show you how to compare portfolio charges across MPS ranges in a matter of minutes.

Join Terry Huddart and Chris Bredin as they show how you can compare MPS performance quickly and easily.

Analyser has been updated to include the ebi Vantage Core, Core ESG and World ranges.

Embark becomes Scottish Widows and Analyser has been updated to reflect this change

If you don’t know where to start with your due diligence and suitability in this Consumer Duty world, we have your back.

Wealthtime platform has now rebranded to Wealthtime Select. The move is part of a wider rebranding exercise which will see Novia rebrand to Wealthtime later this year. Wealthtime Select and Novia are both owned by private equity firm AnaCap. The ownership structure remains the same, with Wealthtime Select and Novia continuing to operate as separate

Analyser has been updated with Sparrows SCore Market Funds (Index Funds Only) ranges.

Canaccord Genuity Wealth Management now available on Analyser

Aspen managed portfolio service is now on Analyser and available for review as part of your investment due diligence.

Join Terry Huddart and Chris Bredin as they show how you can compare platform functionality in a matter of minutes. This is especially useful if you need to export the results into a spreadsheet to share with colleagues or include in reports. Experience it for yourself and start your 14 day free trial.

Deciding which platforms and MPS are core to delivering your proposition and you need to be able to explain the thinking and process behind your decisions. That’s what we preach and it’s about time we took our own advice and explained the thinking and process built into Analyser. So, join Terry Huddart and Mark Polson

You might remember that Novia introduced a new charging structure this year. The first phase was rolled out in January and applied to firms with over £10m in assets on the platform. This saw the number of standard charging tiers go from five to three, with the charge for the lower tiers going from a starting

Charles Stanley’s managed portfolio service is now available to review in Analyser as part of your MPS due diligence. Charles Stanley’s origins trace back to 1792, making it one of the oldest firms on the London Stock Exchange. The company operates a 35-strong research and asset management team, and a key part of its approach

Among the latest wave of MPS providers to join Analyser is Puma Investments. Puma was initially set up to build on a series of venture capital trusts known as the Puma VCTs which had been managed by Shore Capital. It was established as an independent company by chief executive David Kaye in 2012. The Puma AIM

Analyser has been updated to reflect the rebrand of Hubwise to SS&C Hubwise. You’ll notice this change in the Platform Directory and when you run comparisons, due diligence and suitability exercises. This follows SS&C Technologies acquisition of Hubwise and the integration of the platform into the wider SS&C business. The first step as been to

Four MPS ranges from abrdn are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. The ranges are: For details of cost, performance, investment approach and much more on these ranges, log into Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all

We’ve updated Analyser with Quilter’s new platform pricing and subscribers can now: Subscribers to Analyser will benefit from a detailed analysis of the Quilter’s new platform pricing and its implications shortly. Refresh your due diligence Refreshing your due diligence regularly is a matter of minutes as Terry demonstrates in this video.

Artbuthnot Latham portfolios are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a MPS provider or range that you’d like to see on Analyser, let us know and contact the provider

If it’s a quick comparison of platform features you’re after, Analyser can help with that. In this video Terry shows you how to compare as many platforms as you like all in one place, in no time whatsoever.

Puma Investments portfolios are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. They are currently one of only two providers that offer an AIM/IHT specific range on Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a

O-IM portfolios are now available to include in the comparison, due diligence and suitability exercises you run in Analyser. They are currently one of only two providers that offer an AIM/IHT specific range on Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a MPS

Charles Stanley Wealth Managers range of portfolios is now available to include in the comparison, due diligence and suitability exercises you run in Analyser. We’ll share more about them in coming weeks. We’re adding more MPS providers all the time. If there’s a MPS provider or range that you’d like to see on Analyser, let

With Analyser, you’re able to set up your client segments and then tailor your suitability and due diligence to each segment. What’s more, you can also add your own custom pricing. In this video, Abbey and Terry explain how.

With end of tax year done and dusted, it’s the perfect time for a bit of spring cleaning and catching up on those tasks you’ve been putting off for a while. Not to mention acting on some of the changes announced in the latest Budget. In this video, Abbey and Terry take you through a

Quilter Cheviot’s managed portfolio service is now available to review in Analyser as part of your MPS due diligence. One of the UK’s largest DFMs, Quilter Cheviot launched its MPS in 2001 which has £1.49bn in assets under management as at 30 September 2022. It offers five MPS strategies based on what it calls its ‘building

Last week we held an Analyser clinic all geared around refreshing your due diligence, and what this means in practice. Terry and Abbey covered a lot of ground, including why you might choose to review your chosen platforms and providers more than annually, and how technology can help speed up the process. On platforms in

King & Shaxson is now available to review in Analyser as part of your MPS due diligence.

EPIC Investment Partners is one of the latest MPS providers to go live on Analyser, and is now available for review as part of your MPS due diligence. The company was founded in 2001 by Giles Brand and Hiren Patel, who both have backgrounds in private equity. The MPS range was launched in July 2021,

Not sure where to start with your due diligence? We can help with that. We recently added six templates to Analyser to give you a head start on due diligence. They are: These templates have lang cat knowledge and experience baked in. They also benefit from what we know about how Analyser users are using

We’re kicking off 2023 in style with news of a brand-new development – Analyser templates. Here’s a quick rundown of what we’ve built and why.

When we first set up Altor six years ago, we did our initial platform due diligence manually. As a small advice business, we didn’t want to pay lots of money to get an external consultancy to run a due diligence project for us. So we carried out a platform comparison exercise ourselves on a huge

I was originally introduced to Analyser by Terry Huddart at the lang cat, who asked me to be part of the original testing group ahead of Platform Analyser going live. At the time, there wasn’t much out there by way of support on platform due diligence. Some firms did some bits well, but there weren’t

Now that lots of you are starting to get to grips with the new MPS module in Analyser, questions are starting to come in about how we handle performance. Our approach is a bit different to the other tools out there, so read on to find out what we do and why we do it.

Discover the difference Analyser can make to your platform and MPS due diligence

Due diligence done properly | Fiercely independent | Your data remains your data