Client segmentation comes up a lot in our conversations with advice professionals.

When we ask whether a firm segments its client bank or not, sometimes firms will instinctively say no, before outlining the different types of clients they cater for.

Our own State of the Advice Nation research suggests client segmentation is happening across many advice and planning firms to a greater or lesser degree.

Over half of respondents run one to three client segments, and over a third say they run four to six segments.

At the extreme end of the scale, 6% said they operate seven client segments or more.

Approaches are broadly as you would expect, with clients segmented according to life stage, portfolio value, retirement income or age.

Firms we heard from also segment based on other factors too, such as whether clients are part of a family group, want to invest sustainably, or according to investment strategy or low-cost services.

Maybe you’ve formally written down your approach to segmentation, or deal with life stages and other factors within a tailored advice process.

Whatever your approach, the key is to show your homework on your client proposition and target client definitions, and then apply this directly to your due diligence. Anything else and you’re not doing it properly.

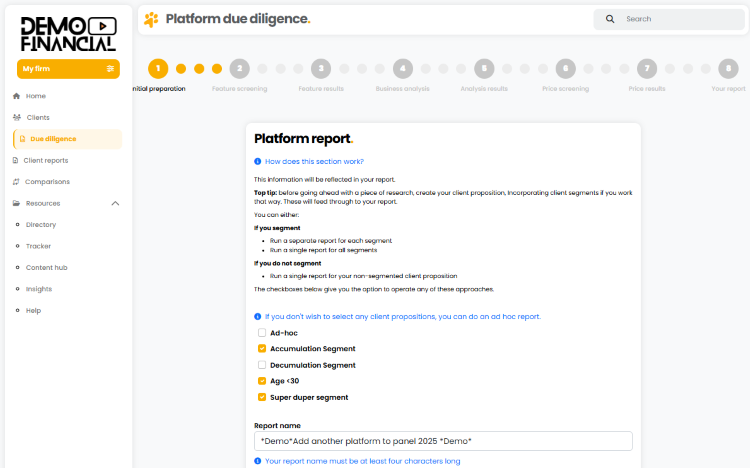

Analyser helps with this by putting your client proposition into the ‘my firm’ section of the system upfront, so that it can then inform your due diligence.

Flexible reporting options

Target client definitions and considering how you serve those different clients are both heavily embedded into Consumer Duty requirements.

Yet whether you segment or not, Analyser works for you.

Based on user feedback, we’ve now made it easier to evidence the most suitable platforms for your clients.

You can now use Analyser to:

- Run individual reports for each client segment

- Combine multiple segments into a single report

- Generate ad hoc reports for non-segmented client propositions

If you do operate multiple client segments or propositions, you can now run one single report which covers several client segments at one time. You can then download these as separate reports.

This should help with documenting and articulating platform selection for different client types. It also saves time and makes the due diligence process more efficient, both for the first time you run a multi-segment report and an ongoing basis.

If you don’t segment, this process will still work for you – just tick the box to create an ad-hoc report as and when you’re reviewing your platforms.

Analyser is geared around research and due diligence that reflects how your firm is set up, your mix of clients and the services you offer – with the reporting to match.

Want to try Analyser for yourself? Get started and experience a slick way to evidence your firm’s platform selection at both a firm and individual client level.